IRS mandatory presidential audit policy goes under spotlight

Dec 21, 2022, 7:04 AM | Updated: Dec 22, 2022, 2:01 pm

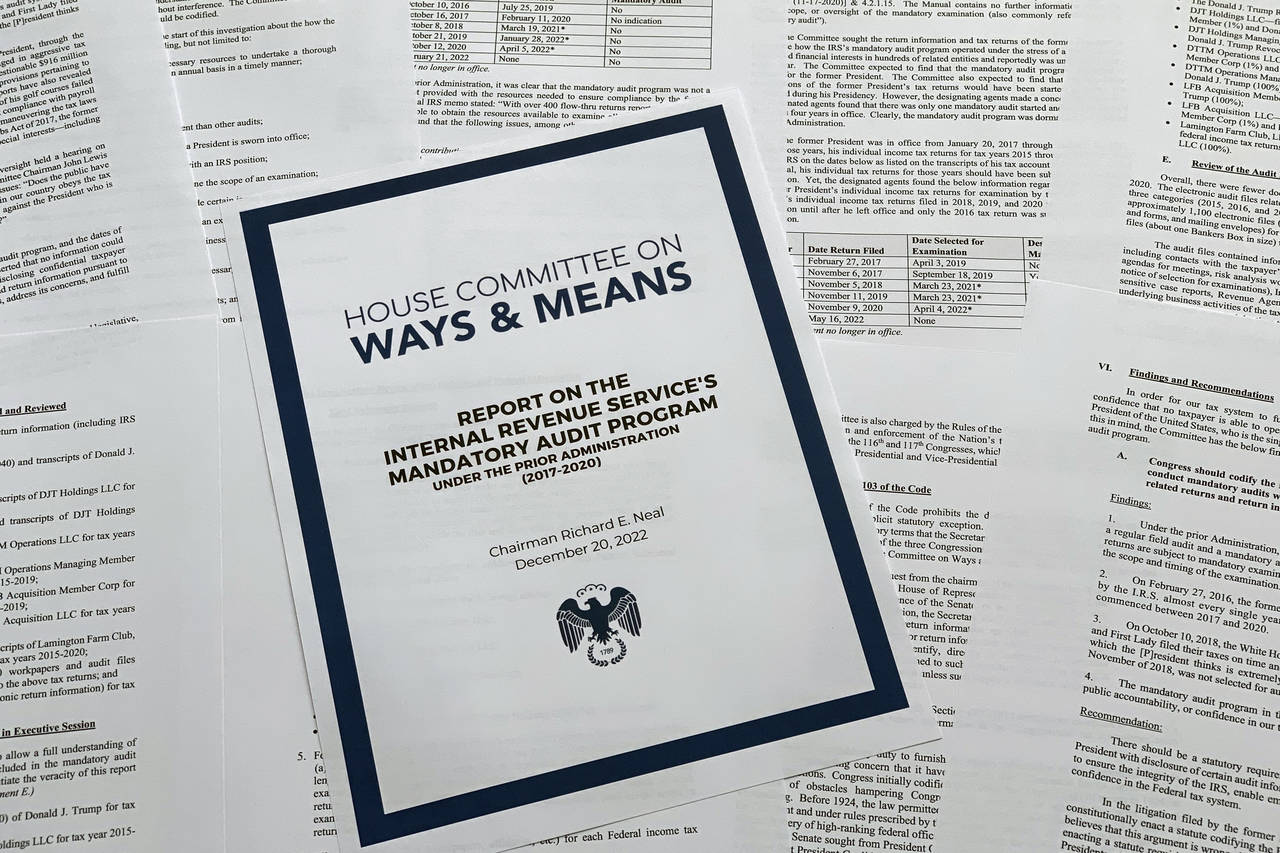

FILE - The report from the House Ways & Means Committee, regarding the IRS and former President Donald Trump's tax returns, is photographed Wednesday, Dec. 21, 2022. The House has taken action after disclosures the IRS never full reviewed Donald Trump’s tax returns during his presidency. The Democratic-controlled House has passed a bill that would require audits of any president’s income tax filings. (AP Photo/Jon Elswick, File)

(AP Photo/Jon Elswick, File)

WASHINGTON (AP) — An IRS policy governing the audits of tax returns filed by U.S. presidents is under new scrutiny after a report published by a congressional panel found the agency failed to perform the mandatory inspection of Donald Trump’s returns until Congress pressed for information about the process.

The three-point policy states that individual returns for the president and the vice president are subject to mandatory review, “should always be kept in an orange folder,” should be kept from the eyes of IRS employees and “should be locked in a secure drawer or cabinet when the examiner or reviewer is away from the work area.”

The report released Tuesday by the Democratic majority on the House Ways and Means Committee said the process, which dates to 1977, was “dormant, at best” during the early years of the Trump administration.

By comparison, there were audits of President Joe Biden for the 2020 and 2021 tax years, said Andrew Bates, a White House spokesman. The first determined the Bidens were due an additional federal income tax refund, Bates said by emails. The second, for 2021, “found that they owed an additional $13, which could have been waived under IRS policy but they chose to pay.”

A spokesperson for former President Barack Obama said Obama was audited in each of his eight years in office.

Democrats in Congress are responding by introducing legislation that would codify the IRS policy into law with more stringent requirements.

Tax experts say the failure to launch the audit earlier is emblematic of a larger problem regarding the IRS’ capacity to examine high-income taxpayers’ returns — and a reminder of Trump as a norm-defying president.

John Koskinen, who served as IRS commissioner during both the Obama and Trump administrations, said the policy has been out of the public eye because presidents have traditionally released their tax-return summaries to the public.

“It only became an issue with a president who refused to release his tax returns,” Koskinen said. “If Trump had been releasing his returns, nobody would have raised this issue.”

Trump’s tax returns being handed over to Congress recently is the culmination of a yearslong legal fight between Trump and Democratic lawmakers.

Steve Rosenthal, senior fellow at the Urban-Brookings Tax Policy Center, said the IRS’ failure to audit Trump shows that “the mandatory auditing program is broken, we cannot rely on the current system to fairly audit the president, and there’s a general problem of the IRS auditing sophisticated taxpayers.”

Rosenthal added: “This is a much larger problem than Donald Trump — yes, he makes bad things worse, but the situation was bad to begin with.”

A new $80 billion infusion of funds through the so-called Inflation Reduction Act is supposed to remedy the beleaguered agency’s low staffing levels, outdated technology and host of other issues. Republicans who are poised to take control of the House in less than two weeks, however, have said they want to cut that funding.

Tuesday’s committee report revealed that the IRS only began to audit Trump’s 2016 tax filings on April 3, 2019, more than two years into Trump’s presidency and just months after Democrats took control of the House. That date coincides with Rep. Richard Neal, D-Mass., the panel chairman, asking the IRS for information related to Trump’s tax returns.

The report’s findings prompted lawmakers to recommend a statutory requirement for the mandatory examination of the president’s taxes, with “disclosure of certain audit information and related returns in a timely manner.”

Senate Finance Committee Chair Ron Wyden, D-Ore., said he will work to pass the bill through the Senate. House Speaker Nancy Pelosi said the chamber would “move swiftly” to advance the legislation.

The issue highlights frustration with the so-called tax gap, which is the difference between how much money is owed to the federal government and how much is paid. IRS data released in October projects that for 2017 to 2019, the estimated average gross tax gap will be $540 billion per year.

Treasury Secretary Janet Yellen said in August, and has repeated at various speaking engagements, that the new funds allocated by Congress would be used to increase audits on high-wealth individuals, firms and complex pass-throughs.

“This is challenging work that requires a team of sophisticated revenue agents in place to spend thousands of hours poring over complicated returns, and it is also work that has huge revenue potential,” she told former IRS Commissioner Chuck Rettig in August.

In an application of the IRS policy on mandatory presidential audits, well-trained agents, forensic experts, tax attorneys and others would be required to oversee a presidential audit as complicated as Trump’s, which included hundreds of businesses, properties and complex business interests.

The congressional report highlighted the lack of staffing and availability of experts to examine Trump’s taxes. The report states that the IRS believed that accuracy of his filings was ensured because he had legal counsel and an accounting firm representing him.

The question of whether presidential tax documents should be disclosed is another matter of debate among tax experts and advocates.

Rep. Kevin Brady of Texas, the top Republican on the Ways and Means Committee, said Congress would be setting a “dangerous new precedent” by releasing the presidential records. Koskinen said that “it’s a significant serious precedent for a committee to seek returns and then release them.”

“I see two big issues here — what is the IRS going to do to ensure presidents are audited regularly, and what’s the rationale for releasing these returns,” Koskinen said.

Rosenthal said he thinks presidential returns should be publicly disclosed to ensure proper oversight.

“When this information is made public, the president is going to be more wary about cheating on their taxes and making them public — the results would put both the IRS and president on their best behavior,” he said.

___

Associated Press writer Meg Kinnard in Columbia, South Carolina, contributed to this report.

Copyright © The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.