Rantz: Seattle Councilmember Lisa Herbold hit with over $32,000 tax lien, won’t respond to questions

Oct 17, 2019, 5:58 AM | Updated: 8:32 am

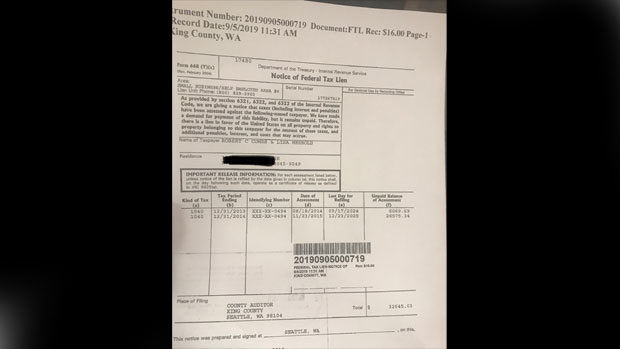

Embattled incumbent Seattle City Councilmember Lisa Herbold and her husband were hit with a notice of federal tax lien from the Internal Revenue Service for $32,645.03, according to a document obtained by The Jason Rantz Show on KTTH.

The lien came just a few weeks before Herbold criticized her opponent for financial mismanagement over a tax lien on a business he doesn’t own.

“We have made a demand for payment on this liability, but it remains unpaid,” the IRS document reads. “Therefore, there is a lien in favor of the United States on all property and rights to property belonging to this taxpayer for the amount of these taxes, and additional penalty, interests, and costs that may accrue.”

According to the document, Herbold and her husband Robert Combs had an assessment of taxes owed in August 2014 and November 2015. The address listed on the document is to their North Bend home, where her husband had been filing personal and business taxes since before they were married.

The document, Form 668 (Y)(c), comes after neglect or refusal to fully pay the debt in time.

Herbold criticized opponent over the same issue

The lien was filed on September 19, 2019, three weeks before Herbold criticized her opponent Phil Tavel for a “pattern of recklessness and mismanagement” of finances, calling him out for a federal tax lien, an amount less than what the Herbolds owe.

Rantz: Seattle Councilmember Lisa Herbold tries to slow homeless cleanups

“Character and judgement MATTER in this job – believe me, I know,” Herbold wrote in a fundraising email.

Allies of Herbold picked up on the criticism. Political consultant Heather Weiner of Civic Alliance for a Progressive Economy published a screenshot of the lien against a business Tavel was associated with. Sources say Weiner pushed the opposition research the lien came from to local media outlets.

But Tavel says it’s not his business.

Tavel tells The Jason Rantz Show that he was briefly general counsel and director of business development for a business owned by a friend. The federal tax liability was assigned to his friend’s new business, Business IQ, after he closed an earlier one that generated the lien.

Tavel was listed as a registered agent and governor on the new business. Tavel says he briefly worked on the previous business, but was not the registered agent or an owner.

The criticisms of Tavel’s business record have angered a number of West Seattle small and independent business owners. The newly formed District One Neighbors for Small Business announced this week that 100+ community business people endorse Tavel over Herbold.

“We just got to a point where we’ve realized that Lisa Herbold does not listen to us. She hasn’t really been engaged with us,” Peel and Press owner Dan Austin recently told the Jason Rantz Show on KTTH.

An explanation

Herbold, in an emailed statement, doubled down on her criticism of Tavel, but ignored the multiple questions I asked related to the tax lien:

Regarding Business IQ, LLC, publically-available documents show that Tavel formed Business IQ, LLC in 2009, and that it was administratively dissolved in 2011. In 2011, Business IQ was hit with a federal tax lien. Tavel was still involved with the company throughout this period. There is no record that this lien has been paid.

As I’ve said before, I don’t expect anyone to be perfect. But I am troubled by anyone who ignores or laughs off their debts. I certainly would not feel comfortable with a City Councilmember who refuses to take responsibility for his debts and his actions.

Herbold does not take responsibility for her debt. Instead, her husband does.

Robert Combs provided a lengthy email saying that he is to blame.

“In 2013 I took on some big contracts with more sub-contractors than I’d ever done before,” Combs, a consultant, told The Jason Rantz Show. “Due to my careless accounting skills I failed to withhold enough from my consulting company and owed. I got on a payment plan for that year fairly easily with a phone call to the IRS. Well, damned if I didn’t do the same thing in 2014. This time the balance was enough that I needed some help. I learned my lesson and got a good accountant and tax lawyer. Anyway, I’ve been on an IRS payment plan for those debts ever since.”

Combs claims that during the government shutdown, the IRS stopped deducting payments of just under $700 a month from his account. He says he paid on time every month, but once the shutdown was over, he began a “Kafka-esque nightmare” of trying to get the payments back on track.

Rather than spend money on a lawyer to handle the situation, Combs said he expected a second letter informing him that he owed a balance.

“This was a bad move!” he confesses. “My next contact from the IRS was in mid September stating they’d put a lien on the house, not exactly the second-notice I was expecting.”

He says, four days after the lien, his payment plan was reinstated, but this has not been verified by the Jason Rantz Show.

When asked if his wife’s criticisms of Tavel were fair, given he doesn’t own the business and says he is not responsible for the debt, Combs punted to the campaign.

A pattern

This is not the first time Herbold and her allies criticized Tavel for conduct where her record is objectively worse. Weiner criticized Tavel for traffic infractions, but Herbold’s record showed considerably more tickets, including for speeding through a school crosswalk and parking in a handicapped spot.

And the email from Combs essentially asks we absolve Herbold of any wrongdoing because, even though her name is attached to the lien, it was a problem he caused. When it comes to Tavel? Herbold makes no attempt at such a courtesy. She goes on the attack, ignoring the debt in her and her husband’s name, while criticizing Tavel for debt he said he doesn’t owe.

This Herbold news comes as a new Crosscut/Elway poll reveals 72 percent of those surveyed in District 1 had a negative view of the Council’s job performance, with 68 percent favoring a change in the direction of the Council.

Listen to the Jason Rantz Show weekday afternoons from 3-6 p.m. on KTTH 770 AM (or HD Radio 97.3 FM HD-Channel 3). Subscribe to the podcast here.

Here is the text from Combs letter:

Hello, I’m Bob, Lisa’s husband. This whole tax fiasco is entirely mine. The only thing Lisa is guilty of here is falling in love with a terrible accountant, and a person who thinks that an average citizen should be able to deal with government in a reasonable manner and not have to kick down a couple thousand for lawyers for simple things. The whole shaggy-dog story follows.

As anyone with an T&M [Time and Materials] consulting business knows, tax withholding isn’t exactly a well-crafted science. In 2013 I took on some big contracts with more sub-contractors than I’d ever done before. Due to my careless accounting skills I failed to withhold enough from my consulting company and owed. I got on a payment plan for that year fairly easily with a phone call to the IRS. Well, damned if I didn’t do the same thing in 2014. This time the balance was enough that I needed some help. I learned my lesson and got a good accountant and tax lawyer. Anyway, I’ve been on an IRS payment plan for those debts ever since.

During government shutdown the IRS quit deducting payments from my account. I got a letter with a list of possible reasons, none of them applied. (I had been paying roughly $700/ month up to this point auto-deducted from my bank account. A payment was never missed.) The IRS notice contained instructions to call an 800 number with a provided case number. During the shutdown, of course, nobody answered. After the shut down the IRS phone lines were up, but entering the case number resulted in “due to high call volumes we are not accepting calls on cases like yours” (paraphrased). Thus begun my Kafka-esque nightmare. This kept up well into the summer. I had a weekly (later bi-weekly) calendar appointment to call at 10:30 every Thursday. In hindsight, this is where I should have swallowed my pride and just paid the lawyer.

I can’t remember if it was June of July when that recording went away, and I was just dumped into hold. Now, the IRS doesn’t have an actual useful hold system where it tells you how deep the queue is or an estimated wait time, or even a call-back option. Nope, you just get to wait, and wait. It’s really fun. I made it to 2 and a half hours a couple of those times before just giving up. I never did connect to any real person. Long about August I was getting a little concerned and I just started just making payments on my own trying to catch up to where I thought I ought to be while I tried to get ahold of the IRS. The hold queues had to shorten up sometime, right? Maybe Thursday is just a bad day to call. I figured at some point they’d send me a second letter stating their extreme official anger and then I’d pay the money and get my tax lawyer to intervene. I really didn’t want to kick down $1k because of some stupid hold system. This was a bad move! My next contact from the IRS was in mid September stating they’d put a lien on the house, not exactly the second-notice I was expecting. And the really, really nifty thing that happens with all that, is the IRS gets to apply a whole bunch of new penalties because, see, _I_ broke the payment plan …. What!? My tax lawyer is still working on that one.

My payment plan was re-instated about 4 days after the lien notice, and the lien should be removed after three months of glitch-less payments. The lien happened while I was in the middle of a re-fi which went pretty upside down because of it. The loan company and I have re-worked the re-fi to include the lien pay-off. I’m hoping to close paperwork by the end of the month and wash my hands of the whole weird mess.

As to why it’s on the North Bend house. I’d been filing my business and personal taxes on that address since 1997 long before Lisa and I got married. Since my taxes are more complex than Lisa’s, I just rolled her simple W2s info into all the templates and worksheets I’d already established on Turbo-Tax and that’s been the address we’ve filed federal taxes under since we got married. After moving everything over to my accountant he pretty much copied the old returns, and it just stayed that way. It’s the address of record the IRS has for filing, so I guess that’s the property they chose. Both properties are listed in the return for interest deductions.

So, things I’ve learned in this process.

1) Trying to do the right thing doesn’t always pay off.

2) God help someone who doesn’t have the means to kick down a cool grand or two when things go sideways with the IRS — You’re basically just screwed.

3) If you think that the person you’re marrying might some day be a public figure, file married but separately.